Xoom vs Monzo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 13:45:36.0 22

Introduction

Cross-border money transfers often involve high fees, slow delivery, hidden charges, and cumbersome user experiences. Xoom and Monzo are prominent services offering digital transfer solutions for different user needs. For those seeking a reliable alternative, Panda Remit provides cost-effective and convenient options. For a detailed guide on international money transfers, refer to Investopedia international money transfer guide.

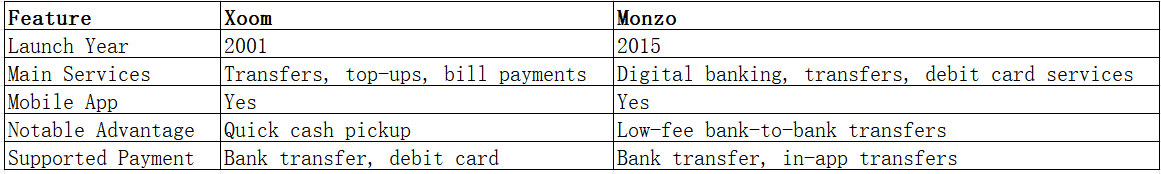

Xoom vs Monzo – Overview

Xoom

-

Founded: 2001

-

Services: International money transfers, mobile top-ups, bill payments

-

User base: Millions, particularly in the U.S.

Monzo

-

Founded: 2015

-

Services: Digital banking, international transfers, debit card services

-

User base: Primarily UK and European users seeking digital banking solutions

Similarities

-

Both provide international money transfers

-

Mobile apps available for easy access

-

Integration with bank accounts and debit cards

Differences

-

Fees: Xoom may charge higher fees for smaller transfers; Monzo focuses on competitive rates for bank-to-bank transfers

-

Functionality: Xoom offers cash pickups and bill payments; Monzo emphasizes digital banking features

-

Target audience: Xoom targets global remittance users; Monzo targets digital-savvy banking users

Another option is Panda Remit, which offers convenient low-cost transfers.

Xoom vs Monzo: Fees and Costs

Xoom fees vary by transfer amount, destination, and payment method, with debit cards often incurring higher fees. Monzo offers lower fees for international transfers, especially via premium accounts. For detailed fee comparisons, see NerdWallet money transfer guide. Panda Remit remains a lower-cost alternative.

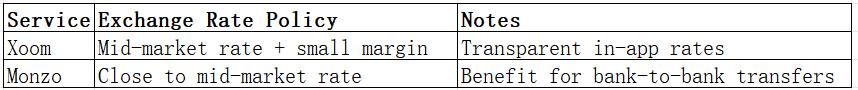

Xoom vs Monzo: Exchange Rates

Xoom applies a small markup on mid-market rates, while Monzo provides near mid-market rates, particularly for premium users.

Panda Remit offers competitive exchange rates for general transfers.

Xoom vs Monzo: Speed and Convenience

Xoom

-

Delivery time: Minutes to hours depending on method

-

App: Fully online operation

-

Payout: Bank deposits, cash pickups, mobile wallets

Monzo

-

Delivery time: Minutes to 1-2 business days depending on destination

-

App: Digital banking with transfer tracking

-

Payout: Bank-to-bank transfers, card-to-card options

For more information on transfer speeds, see World Bank remittance guide. Panda Remit provides fast online transfers as an alternative.

Xoom vs Monzo: Safety and Security

Both Xoom and Monzo are licensed and regulated, offering encryption and fraud protection. Panda Remit is also a secure, licensed option.

Xoom vs Monzo: Global Coverage

Xoom supports over 130 countries and multiple currencies. Monzo provides global digital banking coverage with bank-to-bank transfer capabilities. Both support flexible payment methods. Detailed coverage: World Bank remittance coverage report.

Xoom vs Monzo: Which One is Better?

Xoom is ideal for users needing fast online transfers with multiple payout options. Monzo suits digital-savvy users seeking low fees and integrated banking features. Panda Remit may provide better value, speed, or convenience for certain users.

Conclusion

When comparing Xoom vs Monzo, Xoom excels in fast, fully online transfers with cash pickup options, while Monzo benefits users seeking low fees and digital banking capabilities. Panda Remit offers several advantages:

-

High exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank transfer, e-transfer)

-

Coverage of 40+ currencies

-

Fast, all-online transfers

Explore more at Investopedia, NerdWallet, or try Panda Remit for a reliable, cost-effective transfer solution.